The New Stamp Duty Law 2020 in Indonesia

The Stamp Duty Law in Indonesia: A Glance on Its Revocation.

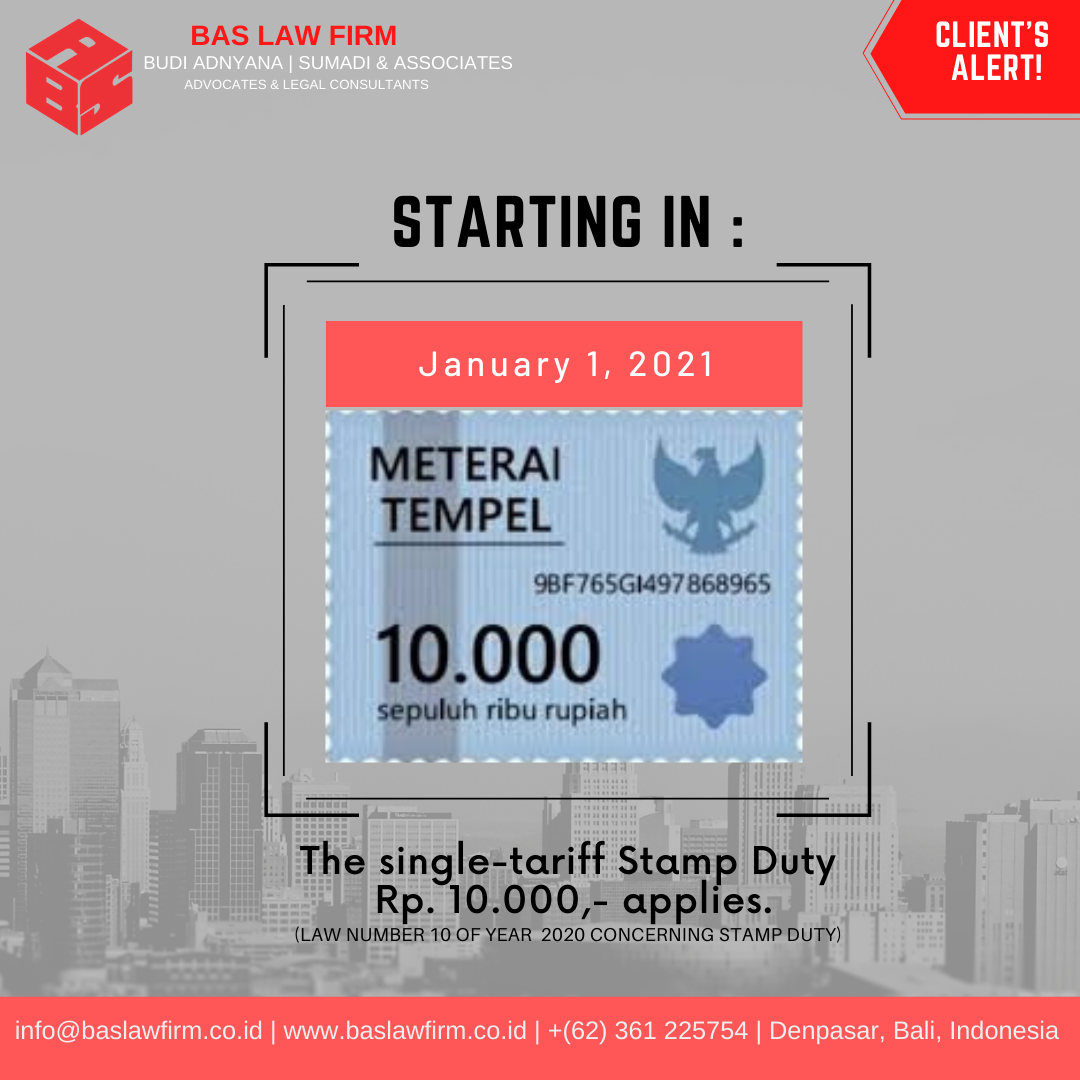

The Indonesian Government just passed the Law Number 10 of year 2020 concerning Stamp Duty (“Stamp Duty Law 2020”) which revokes the previous Stamp Duty Law Number 13 of year 1985.

There are major changes on the new Stamp Duty Law 2020 in which will be imposed to any legal documents that used in Indonesia. The following key changes are:

The Effective Date : This new Stamp Duty Law 2020 will come into effect in January 1, 2021; means in 2020, the old stamp duty remain applies.

The Transition Provision : Stamp Duty which has been printed based on Law-13 can be used for a year after the effective date of this Law with a total value of minimum IDR 9,000. These stamps cannot be exchanged for money.

The New Form : Aside from the paper Stamp Duty form, the new Stamp Duty Law 2020 introduces a new form concept of electronic stamp duty. This electronic stamp duty will be stipulated in the Ministerial Regulation.

A Single-Tariff Applies : Difference with the previous tariff which has been ruled a double-tariff i.e. IDR 3,000 and IDR 6,000; the new Stamp Duty will apply for a single tariff or fixed tariff in amount of IDR 10,000.

Stamp Duty Objects : Stamp Duty is imposed on the following documents:

a. Documents created to explain events of a civil nature; and

b. Documents to be used as evidence in Court.

Documents of a civil nature as intended in letter (a) above include:

a. Agreements, certificates, statement letters, or similar documents along with copies thereof;

b. Notarial deeds and Grosse, including copies and excerpts;

c. Deeds of a Land Deed Officer along with the copies;

d. Securities in any form and name;

e. Securities transaction documents including for futures contract transactions in any name or form; ‒ new

f. Auction documents in the form of excerpts, minutes, copies and grosse; ‒ new

g. Documents stating a sum of money above IDR 5,000,000 (five million rupiah) which:

1. Describe the receipt of money; or

2. Contain an acknowledgement of debt payment or settlement, either entirely or partially; and

h. Other documents stipulated by Government Regulation (GR). ‒ new

Exemption Objects : Temporary or Indefinite exemption from the imposition of stamp duty shall be granted in relation to certain types of documents, as follows:

- Documents which address transfers of rights over land and/or buildings in order to accelerate the restoration of socio-economic conditions;

- Documents which address transfers of rights over land and/or buildings used for non- commercial regional/social purposes;

- Documents which promote or implement government programs;

- Documents that relate to implementation of international agreements or based on reciprocal arrangements.

Any updates on the implementation rules of the Stamp Duty Law, please contact us at [email protected]

.png)